457 withdrawal calculator

The system only works with. Expected Retirement Age This is the age at which you plan to retire.

457 Retirement Plans Their One Big Advantage Over Iras Money

A 457 can be one of your best tools for creating a secure retirement.

. This calculator assumes that the year you retire you do not make any contributions to your 457. Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. A competitively priced plan with total fund expenses of 031-044 A proprietary lineup of core institutional.

Use this calculator to determine how long those funds will last given regular withdrawals. Use this calculator to help. So if you retire at age 65 your last contribution occurs when you are actually 64.

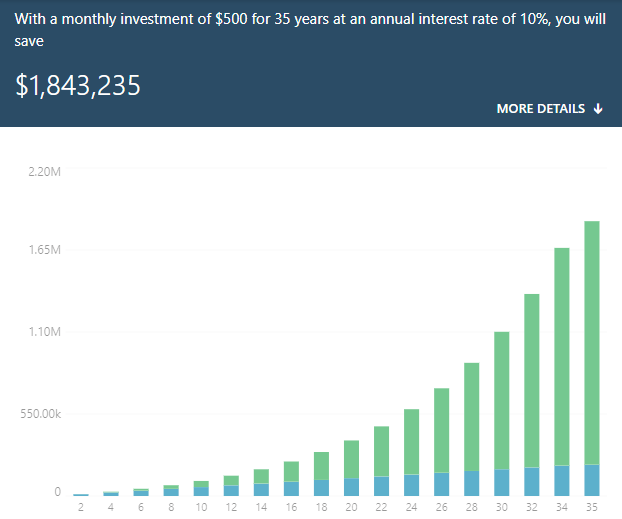

Withdrawing 1000 leaves you with 710 after taxes 457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. It provides you with two important advantages. You will find the savings withdrawal calculator to be very flexible.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Use this calculator to see what your net withdrawal. The CalPERS 457 Plan offers several benefits to your employees including.

The 457 withdrawal calculator is very easy to use. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. You have worked hard to accumulate your savings.

All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. It is designed to help you work out how much tax you will pay on any funds you take from the account. Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Retirement Withdrawal Calculator Terms and Definitions. This calculator assumes that the year you retire you do not make any contributions to your 457. Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Ad Schedule an Appointment With Fidelity To Help Determine Your Retirement Goals. First all contributions and earnings to your 457. Current savings balance Proposed monthly.

For example if you retire at age 65 your last contribution occurs when you are actually 64. All withdrawals are taxable regardless of the participants age. This calculator assumes that the year you retire you do not make any contributions to your 457.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Amount You Expected to Withdraw This is the budgeted.

While it is most frequently used to calculate how long an investment will last assuming some. See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. To retire is to withdraw from active working life and for most retirees retirement lasts the rest of their lives.

For example if you retire at age 65 your last contribution occurs when you are actually 64. Our Retirement Calculator can help by considering inflation in several. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Use this calculator to see what your net withdrawal would.

Tax Benefits Of 403 B And 457 Plans

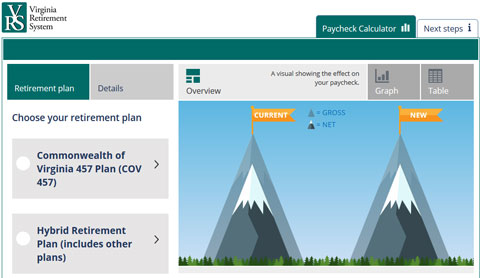

Vrs Contributions

A Guide To 457 B Retirement Plans Smartasset

A Guide To 457 B Retirement Plans Smartasset

457 Plan Types Of 457 Plan Advantages And Disadvantages

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457b Plans Non Qualified Deferred Compensation Plans Apa

Can I Max Out My 401k And 457 Here S How It Works

457 Plan Types Of 457 Plan Advantages And Disadvantages

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Can I Max Out My 401k And 457 Here S How It Works

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

457 Contribution Limits For 2022 Kiplinger

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

457 Vs Roth Ira What You Should Know 2022

457 B Plan What Is It Full Guide Inside

403 B Vs 457 B What S The Difference Smartasset